Discover more from Market Sentiment

Hello! I’m putting together this series to bring you diverse experiences and perspectives of other investing writers. Could you take a minute and answer just 4 questions to let me know what you feel about this series? Here’s the link.

If you’re new here, you can subscribe by tapping this button for content that will make you a smarter investor.

If your financial situation makes it difficult to sleep at night, something is off.

Today’s guest is my friend Jack Raines. Jack writes on his newsletter Young Money about topics ranging from risk-taking and travel, to oil commodities and the dangers of Web3. His writing is sometimes wild but always fun, complete with hand-drawn pictures. His deep-dives and honest sharing of experiences can help you understand your own tolerance and priorities. It’s one of the best reads out there to tune your psychology for investing.

If you’re strapped for time, here are the key takeaways from this interview:

Easy money doesn’t last long. Jack dives into his story of how he lost $150k in a single day trading options, and what he learned from the experience. How did he manage to do this? And is he ok now? You can just read the first question of the interview to find out.

You only have so many opportunities to do so many things and the experiences that you skip out on can’t be “bought back” later.

Knowing your priorities and having a sense of enough are crucial in investing. Money is a way to achieve freedom, stability, or access to opportunities. Once you achieve critical mass, ask yourself if the time and attention you are investing in the chase are worth it, and reprioritize.

The real alpha comes from increasing income rather than optimizing portfolio performance if you don’t have a 7 figure balance.

You know you are taking too much risk when you start rationalizing your decisions to fit what you want to happen rather than what is actually happening.

If the investment thesis can’t be conveyed in a few simple sentences, it’s probably a poor investment idea. Yes, he’s talking about crypto here. Read on to know the six reasons why crypto is not yet a good investment.

Now that you know what’s in store, strap on for a…

Rollercoaster ride in Options-land

One of your wildest articles was “How I lost $150k in a day.” Reading that article, I was curious - How did your life get to that point? Was investing always in the plan? How did you get started?

Great question. That day marked an important turning point in my life. I’ll try to keep this fairly short.

For some context, I finished college in December 2019. I spent the next two months applying to all sorts of finance jobs (typical for a finance major), and my extended free time online led me to Wall Street Bets, the popular Reddit page. Around this time, the stock price of a certain electric vehicle company went ballistic, and some investors (gamblers?) made millions. Naturally, I felt the FOMO.

I started working in corporate finance for UPS in February of 2020, and about a week into my tenure, the Covid crash started. I saw a ton of posts on Reddit claiming that everything was going to 0, so I put all of my money in SPY puts (great risk management, right?)

I turned $10k into $30k in a few days, and I thought I was the next Michael Burry. Then that $30k turned back into $10k (because I shorted the literal bottom), and I realized I was an idiot.

I planned to invest $6,000 in my Roth IRA in index funds, and be responsible.

Until a few weeks later, when my friend texted me about DraftKings going public through a reverse merger with something called a SPAC. I was intrigued, but I had no idea what that meant. However, I tracked the SPAC’s stock price, and I noticed that

it was essentially a risk-free asset near $10 (pre-merger) because of SPACs’ redemption feature, and

when DEAC shares (the SPAC that took DraftKings public) increased by 100% or so premerger, the warrants (which are like 5-year call options with an $11.50 strike price) increased by 700%.

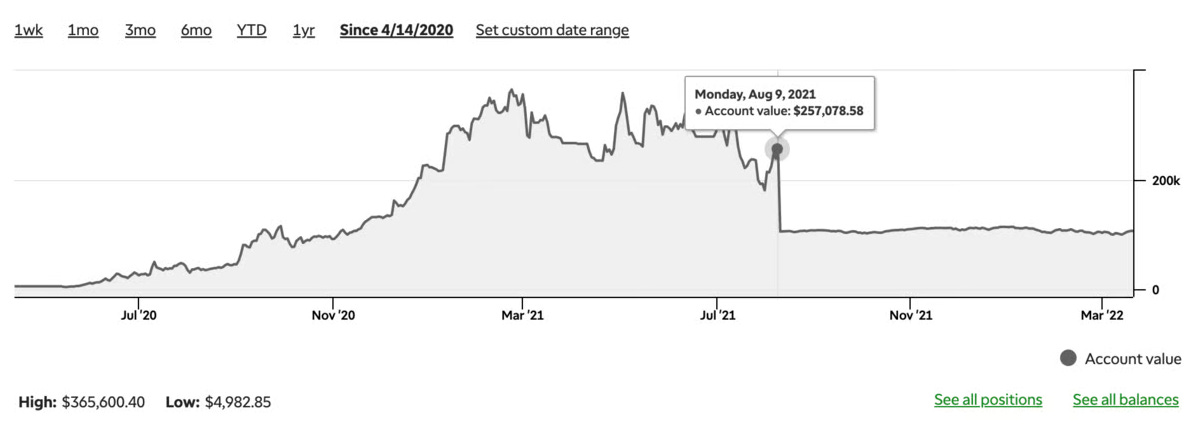

I realized warrants gave you the upside of call options minus the shorter time constraint, and I had to find the next SPAC. So Nikola Motors starts gaining traction. The company seemed ridiculous, but everyone wanted the next Tesla. I bought $6,000 in warrants and make $20k (it would have been like $50k if I had held longer lol). And I kept parlaying warrants in different SPACs until I hit $160k or so. At this point, I started buying SPAC shares, because they provided limited downside (redeemable for $10 cash) while still offering some upside in the bubbly sector.

At my peak, I had turned $6,000 into $400k, more or less.

Over this 10-month period, I joined and grew a community of other SPAC traders who were running similar strategies. Collectively we made several million dollars between 2020 and early 2021.

Unfortunately for me, the SPAC market got saturated (not a huge surprise, easy money never lasts long). I didn’t take any big losses thanks to the floor on SPAC prices, but the easy gains were gone. So I broke my strategy and took bigger risks by trading former SPACs that no longer had downside protection.

I had $300k+ in a buy-now, pay-later company that had gone public through a SPAC because it was undervalued vs its peers, but a poor earnings report last August cost me $157k in about six minutes (thank you, Katapult.)

I don’t know if investing was always the plan, honestly. I just got bored during Covid and found a lucrative strategy.

How has your approach to money changed over time? On the same note, is there one idea that you picked up in the last few years that changed your perspective (on money, life, career, anything)?

When I was wheeling and dealing SPACs, the only thing I could think about was “more”. I was making so much money, my dopamine receptors were off the charts. Imagine being a 23-year-old kid who made $400k from hitting buttons on his phone? Just a ridiculous experience.

However, I was becoming increasingly aware of two things:

the money wasn’t necessarily making me happy. In fact, I was stressed out by my position sizes. But I literally couldn’t stop.

Trading had consumed my life to the point that pretty much all of my conversations and thoughts were on the market.

Losing that money was a crucial wake-up call. I was still up significantly from my initial $6,000, but I was also able to step back and see just how much this had consumed my life. I cashed out, bought index funds, and decided to take a break from the markets for a while and regroup.

Around this time I also became increasingly aware of the tradeoff between money and time. This was probably a byproduct of working remotely from my apartment for 18 months on end, but I felt like I was sleep-walked through the first year and a half of my career. And honestly, it scared the shit out of me. Like, is this what adulthood is? Just doing work you don’t really like, getting paid for said work, trying to ignore the boring reality of my existence on Saturday and Sunday, and repeating it till retirement/death?

The opportunity cost of time became this idea that I couldn’t shake. And from this, I began to realize that as someone in their 20s with a newly found windfall of cash (thank you, SPACs), there were certain experiences that I could pursue now that just wouldn’t work later.

To sum it all up in one sentence: You only have so many opportunities to do so many things, and the experiences that you skip out on in your 20s can’t be “bought back” 30 years later.

So I leaned into these experiences hard. Two weeks after blowing $157k in a day, I quit my job and bought a one-way ticket to Barcelona, with no plans to return.1

Takeaways for investors

What is the biggest mistake that new investors make? What can they learn to save themselves a lot of pain?

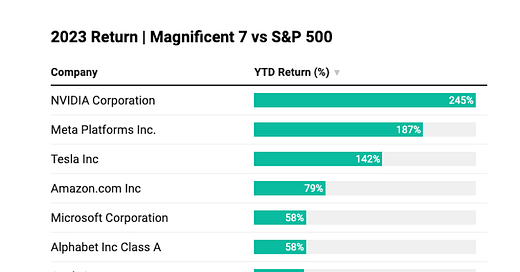

Worrying about portfolio alpha with small portfolios. If you don’t have at least 7 figures (and new investors typically don’t), increasing income is far more important than increasing % returns.2

If you have $50k, and you make a 100% return (this isn’t sustainable), you make $50k. How many other ways could you make an additional $50k by increasing your income? And you could simply invest that extra income to make market returns? Active investing is one of the few fields where you could invest 1,000 hours and still lose money.

What’s one investing decision you’re happy about in hindsight? And one investing decision you regret?

I don’t regret any investment decisions as both the gains and losses led to where I am now. The one I’m most happy about is knowing to stop after that $150k loss, because my first impulse was to think about how I could quickly earn it back. That likely would have been a disaster.

Is there any investor or institution whose approach to investing you admire?

For VCs, I think Josh Wolfe and the Lux Capital team are awesome. Josh shares a ton of content online, so I have a good feel for his thought process and how Lux evaluates possible investments.

For individuals, I basically do the same thing as Morgan Housel: buy indexes to maximize likely gains per effort exerted. I think the real alpha is increasing income to make higher net passive returns, vs. spending countless hours pursuing portfolio outperformance.

Managing risk

If risk is good, should investors take on risk in measured doses (like cold exposure therapy?) If so, what’s the best way of experimenting with risk?

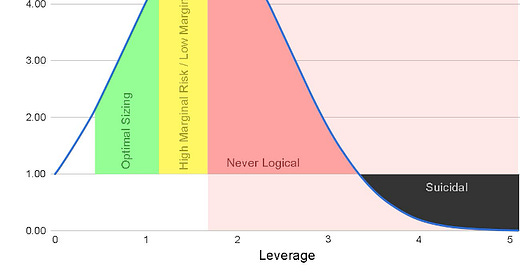

Risk is simply risk, how investors handle it is what’s good and bad. The key is knowing what the risk is beforehand, and accepting personal responsibility for the outcomes of your own actions, regardless of the results.

A good way to know if you’re taking too much risk is if you start rationalizing your decisions to fit what you *want to happen* instead of accepting reality for what it is.

Are some kinds of risks just not worth taking? The idea that “higher risk implies higher rewards” seems to be increasingly used to sell Cryptos and NFTs, but it feels like an unfair comparison to other kinds of risk. How can people assess and separate different types of risk?

Being aware of the risk beforehand is the key. I would never recommend “investing” in casino games (aka gambling), but if you are aware of the risk and want to play blackjack, go for it. That applies anywhere.

When you find yourself rationalizing poor decisions through confirmation bias, the risk isn’t worth it. Confirmation bias is rampant where risk is highest, in my experience. Again, risk is simply risk. Investor behavior regarding risk is the factor that matters.

FOMO is probably one of the hardest things to resist. Despite scams, crashes, taxes, lawsuits, fears of bubbles, etc. Crypto still seems to persist. The fear that “we’re NGMI” is probably pushing a lot of people into things that they have no knowledge about. But I wonder where this is heading in terms of the larger trend.

In spite of your predictions in “ When community is shaped like a pyramid”, if Crypto and NFTs persist, what would it mean for investing and the economy in general?

Crypto is the nth version of a greed and fear cycle that has existed as long as mankind. The difference is that the internet has made communication and the spread of information quicker and easier than ever before. Bubbles inflate quicker and more violently than ever before as a result. (I touch on this idea here)

Think about the Tulip Bubble. If you lived in Florence, it may take weeks (if ever at all), for you to hear about this new bubble in Holland. Now? Information is spread instantly, and FOMO permeates as a result. People were launching Queen Elizabeth cryptocurrencies within 30 minutes of her death. The instantaneous spread of information has changed the game.

Could you be wrong? Can you play the Devil’s advocate and think about a world in which Crypto and NFTs have an actual use case?

Sure, crypto “could” eventually give way to a mainstream currency and NFTs could become a widely accepted form of art or be used as tickets/keys for entrance to events and groups (though I have strong doubts), but I have a few thoughts on this:

Use case ≠ good investment. Why would use cases mean that certain assets are worth $X? There is a logic gap here.

We have a trillion-dollar asset class, where startups are raising $100M+, when they are “looking for use cases.” This doesn’t make any sense. The common comparison is “oh but the internet.” Yes, the monetization of the internet in its early days had room to evolve, but the internet’s “use case” was never in question. You could exchange info and communicate with everyone. Compare that to the obscurity of Web3 startups today and they just aren’t in the same ballpark.

Tokenization encourages grifting3 and selling stories over building useful products, because you can cash out immediately if people buy into your story. If you can get paid before actually building anything useful… why would you build anything useful?

Most of the biggest proponents of this space have a vested interest in making other people believe that these projects will take off. If you front-run everyone with a crypto investment and can liquidate immediately, you are, of course, going to promote it heavily.

Seems like a lot of crypto leaders are happy to take US dollars.

The narrative changes every month. Inflation hedge? Not anymore. I have no idea what the main storyline will be by Christmas, but something will catch on.

Crypto has given me a good idea of what *not* to invest in: if the investment thesis can’t be conveyed in a few simple sentences, it’s probably a poor investment idea. The more complex jargon and ambiguous language, the biggest the red flags.

Also, it seems to me that the endgame on crypto is the financialization of everything. Do we really want to turn every interaction into a transaction? No.

Closing thoughts

Which article of yours is the most popular, or most talked about? Does it surprise you?

Some of my most popular pieces are

Another one that has less to do with money, but also performed well, is “The Case for Traveling More”.

Which article or idea of yours is your personal favorite?

My personal favorite is the “The Case for Traveling More”. I think everyone should get out and see the world more, and it encompasses one of my most strongly-held beliefs: money is best used to buy experiences.

Would you recommend any books or resources that you really love?

A few books:

Greenlights by Matthew McConaughey

Man’s Search for Meaning by Viktor Frankl

Vagabonding by Rolf Potts

The Psychology of Money by Morgan Housel

The War of Art by Stephen Pressfield

Finally, do you have any idea or suggestion that our readers can take away to become more well-informed investors, or even make investing a little more enjoyable and stress-free?

If your financial situation makes it difficult to sleep at night, something is off. Maybe this means your bank account is empty. Maybe you have plenty of money, but you are on call 24/7 with a stressful job. Maybe you have taken on too much risk in your portfolio.

The “can I sleep well” test holds up well.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

But first, go to Young Money and subscribe (it’s free!). It’s one decision you won’t regret.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Footnotes

A side note from Jack: I had been accepted to Columbia Business School back in 2019 through a deferred enrollment cohort: basically I would work 2 - 5 years before starting my MBA studies. I knew I was going to Columbia in Fall 2022, so I gave myself 1 year to quite literally have as much reckless fun as possible as a 24-year-old. 1 year later, no regrets.

Note from Market Sentiment: Throwback to my article on getting a good start, which covered this in more detail.

Note from Market Sentiment: The Golden Age of Grift by Jack is one of my all-time favorite articles.

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

love the information. disagree that just because something is complex, it's not worth investing. i'm pretty sure that steve jobs and bill gates had problems in the beginning explaining the use of the personal computers. there are possibilities in blockchain and a noncentralized transactional network. it has just drawn too many fools and unscruplous into its net.

Great interview! 💚 🥃