Discover more from Market Sentiment

Welcome to the 300+ investing enthusiasts who have joined us since last Sunday. Join 29,500+ smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

"There are decades where nothing happens; and there are weeks where decades happen" ~Vladimir Ilyich Lenin

This was certainly a week like that. FTX - The world’s 3rd largest crypto exchange, valued at an incredible $32 Billion, vanished overnight. The company and all its subsidiaries have just filed for Chapter 11 bankruptcy. It’s one of the biggest collapses we have seen after Lehman - VCs have already started marking their investment down to zero and it’s going to be next to impossible for regular users to get their funds back. While the story is still breaking, here is everything you need to know about the collapse of FTX.

How does a bank work?

"Every banker knows that if he has to prove he is worthy of credit, in fact his credit is gone" ~Walter Bagehot

Let’s start with how a regular bank works. Contrary to popular belief1, banks do not keep all the money that you put in the checking account with themselves at all times. They lend it out to others at a higher APR to others and they pocket the difference as profit.

How much they can lend out is based on the reserve ratio set by the Federal Reserve. If a bank has $1B in customer deposits and a reserve ratio of 10%, they are only expected to hold $100M in their accounts. The remaining $900M can be lent out to others. The money that was lent out again goes into other banks and the cycle repeats. The benefits of this system are apparent - You can cycle the same money through the economy multiple times and credit access becomes easier without creating additional money.

The problems of this system are also apparent - This puts the banks at the constant risk of bank runs. What if all the customers come back at the same time and ask for their money back? Forget all customers, if more than 10% of the depositors demand their money back in one go, we have a problem! (If you think bank runs are rare, think again! - they have occurred multiple times in the U.S)

The Govt. and the Federal Reserve have multiple safeguards in place to prevent this. First and foremost is the deposit insurance - If the bank you have put your money in is FDIC insured2, deposits up to $250K are automatically insured. i.e, no matter what happens to that bank, you can be assured that you will not lose your deposit. Further, if a bank run actually happens, the central bank would step in and make a short-term loan to the bank so that it will remain solvent. In fact, the existing system is so robust that no depositor has lost a penny of FDIC-insured funds since 1933.

Alameda, FTX & FTT

There are three components to unraveling this puzzle.

Alameda: This is where it all starts. Sam Bankman-Fried (SBF) created this quantitative trading firm in 2017 to take advantage of a Bitcoin arbitrage. The price of Bitcoin in Japan was higher when compared to that in the U.S. So you could make a nice profit by buying Bitcoin in the U.S and then selling it in Japan. They later expanded to other strategies involving Yield farming, trading volatility, and finding arbitrage.

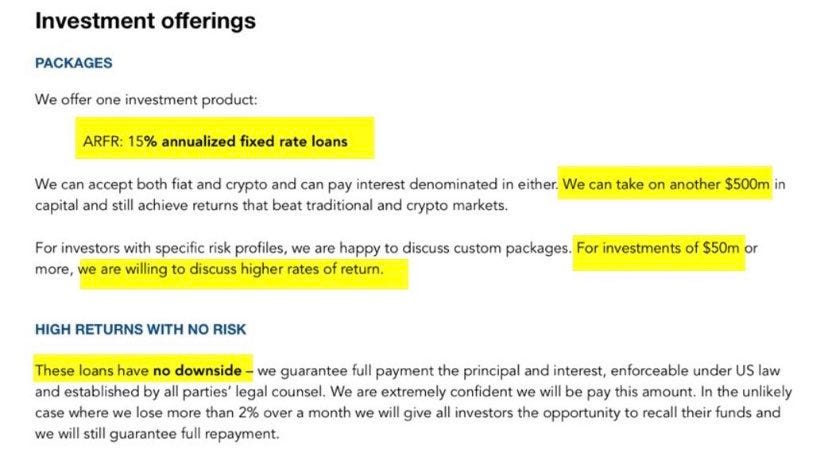

The firm’s recent pitch deck, which was available only to institutional investors, was filled with red flags.

FTX: The irony is that FTX was set up to overcome the rules and regulations set up by the U.S banks in trading cryptocurrencies. Even though the Alameda team made $20M by arbitraging Bitcoin prices across the planet, they had to spend a considerable amount of time at traditional banks to process these transactions.

The platform was “built by traders, for traders”3 and offered complicated crypto services like derivative and spot trading in addition to acting as a regular exchange. The timing for founding FTX could not have been any better and the firm was valued at over $30 Billion in just 3 years.

FTT: FTT is an exchange token that was launched by FTX a year after its founding. All big exchanges offer their own tokens (Binance - BNB, Crypto(dot)com - CRO, Kuoin- KCS, etc.). The tokens are launched usually for raising capital, covering transaction costs, and providing liquidity to the exchange. Using an exchange token can give considerable benefit to the trader - in the case of FTX, using FTT reduced trading fees, got them a better deal on the Futures and FTT could be used as collateral for future positions. One key problem with exchange tokens such as FTT is that they have remarkably low liquidity compared to their size. As a reference, while Bitcoin had 10-30% of its entire market cap trading every single day, FTT had only 1-2%!

Those pesky regulations

Unlike a bank, an exchange is not supposed to do anything with customers’ deposits. The exchange is just supposed to safeguard the deposits and make them available for the customers whenever they want to trade. In traditional financial firms where you save your retirement money, the rules and regulations are much stricter. In the case of Fidelity, customers’ cash deposits are insured by the govt for up to $1.25MM and equity investments have protection for up to $500K.

Even if you were a bank (which FTX wasn’t), you would have to abide by rules and risk metrics that are defined by the central bank. You cannot lend to anyone and are expected to maintain a minimum reserve. In the worst-case scenario, the central bank will step in - an idea that goes back to 1913.

The point of a central reserve, which is what Paul Warburg and Nelson Aldrich had in mind in 1913, is that the pooled resources of the nation are immeasurably greater than those of any single mogul. They offer, in times of need, an ocean of liquidity to iron out the inevitable fluctuations in individual, regional, and industry-specific credit. - Roger Lowenstein

What went wrong?

“Only when the tide goes out do you discover who’s been swimming naked” ~ Warren Buffett

Now that we have a clear picture of all the moving parts, we can put together what actually went wrong. The latest allegations (as reported by WSJ) suggest that FTX transferred billions of dollars in customer assets to their trading firm Alameda to make risky bets. Of the $16 Billion that customers had deposited into FTX, close to $10B was transferred over to Alameda.

FTX was able to do this by using its own coin FTT as collateral for borrowing the real coins deposited by customers. So even if the deposits were backed 1:1 in theory, it all heavily depended on the value of FTT. FTT at its peak had a market value of more than $7B. As with all crypto coins, the value of the coin is completely dependent on the perception of investors. This is where it all starts going wrong.

Since FTT is a very low-volume coin, a large move in the market can considerably drop its price since there wouldn’t be enough buyers for the coin. When Coindesk released a report on Nov 2 stating that the majority of Alameda’s assets (~40%) were FTX’s own exchange token FTT, it spooked the market. The final nail in the coffin was when CZ, the CEO of Binance (the World’s largest crypto exchange) announced that he was liquidating $2.1 billion of BUSD and FTT that they received from the FTX exit. He was basing this move on the report from Coindesk.

The market response was instantaneous. Even though Alameda tried to stop the bleeding, it was too late. By the next morning, the price of FTT had dropped by close to 90%!

The cratering price of FTT spooked4 the traders on the platform and they all ran for the exits. Users tried to pull an estimated $5 billion from the platform in a single day and FTX did not have the assets to cover it. They eventually tried to set up a deal to be acquired by Binance. While Binance tried to bail them out, the hole in the balance sheet was so much that they pulled out after a mere 24 hours of due diligence. And unlike in the case of traditional finance, there is no central bank to bail out FTX! You know, live by the sword, die by the sword…

On Friday, FTX, FTX US, and Alameda filed for Bankruptcy.

But, why?

One thing that fascinated me during all this is that I could not figure out why people take such extreme risks. It might just be me, but if I am running a multi-billion dollar exchange making eight figures every day just in exchange fees, I would never be risking my clients’ assets or taking unnecessary leverage.

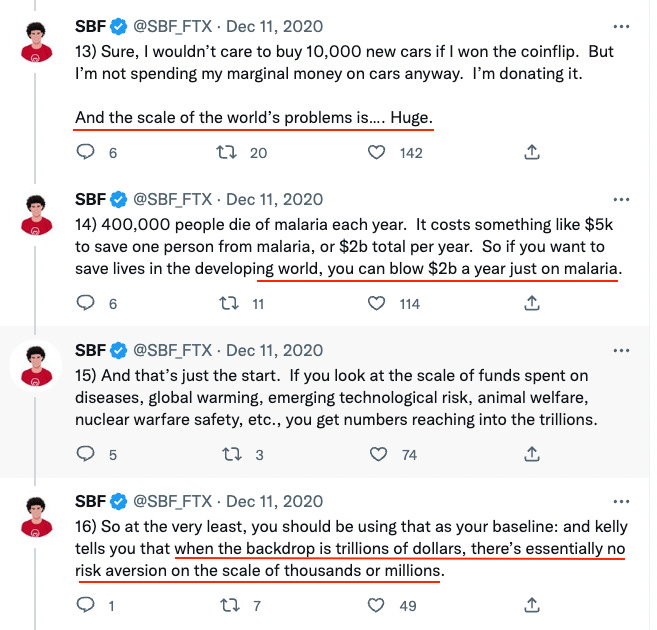

This thread from my friend Matt gives an in-depth look into the psyche of SBF that made him take crazy bets. Here we can look into the thread SBF himself made in 2020. It talks about his thought process behind making bets. The question he is asking here is: how much would you bet if you had $100K and you win only 10% of the time? (If you win, you would get 10,000x of your bet).

Kelly criterion is a formula that’s used to calculate the optimal size of a bet when the expected returns are known.5 For the above thought experiment, if you use Kelly’s formula we get the bet size of ~$10K. This is the maximum that you should bet given the low probability of success.

But SBF goes much farther - for him the optimal bet is 5x this amount. Why? He says he wants to solve the key problems in the world and their scale is huge. A noble but misguided thought process.

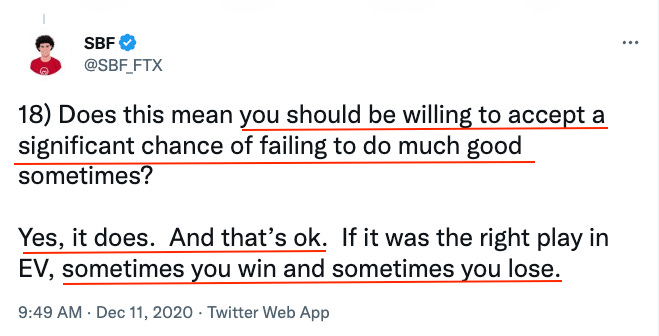

Finally, he concludes by saying that you should be taking a significant chance (aka risk) if you want to create a significant impact.

In the end, Matt shows him that betting more than the amount recommended by Kelly is extremely risky and SBF just says “we have to agree to disagree”.

If SBF’s plan was to maximize the benefit to the world, he should have just risked his own money. That way if he wins big, we would all benefit but if he ends up losing it all, the impact on others would be minimal. Making multi-billion dollar bets using customers’ money who trusted him is anything but altruistic.

26% of respondents in our recent survey of 1,000 US consumers believed that banks are required to keep 100% of deposits in their reserves.

As it 100% should be - Otherwise change your account today!

Ironically, Enron had the same motto.

Understandable as the majority of the valuation of FTX was based on the FTT coin.

Check out my article on bet-sizing using the Kelly criterion here.

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

What was he doing in Politics asking for regulations while he was risking customers money?! At this point it may have not been illegal, but it was definately unethical. An exchange should not have the ability to risk the customers investments in coin, and without their knowledge.

Keep in mind that the Fed doesn’t print money. Banks do by creating loans. They give cash to the lender for a collateralized loan. The borrower takes the money and pays it for, say, a house. The builder deposits that money and the cycle starts as above. It all starts with the bank.