Discover more from Market Sentiment

Blackjack, horse races, and the stock market - What do they have in common?

How did an unassuming math professor break the casino and then go on to build one of the most successful hedge funds of all time?

What can you learn from the world of gambling to manage your money safely?!

There is a lot of emphasis in the investing world on the buy-and-hold philosophy. And it makes sense because a lot of the greats like Ben Graham, Warren Buffett, and Charlie Munger preach the message that for compounding to work its magic, you need to give it enough time. They are also big champions of diversification.

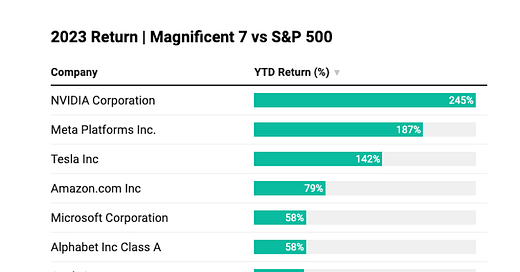

But a segment of their stories that is usually left out is that they got their first big break by betting a huge portion of their portfolio on very few bets. On the other side of the buy and hold crowd, there are funds that have instead made money with a huge volume of trading - Like Renaissance Tech's medallion fund, and Ed Thorp's Princeton-Newport. I agree that it's madness to imitate their activity without understanding the fundamentals. But what is the underlying principle to their success?

To understand that, let's take a look at the world of gambling.

Gambling and the stock market

Gamblers get a bad rap for indulging in a decadent vice. But there’s an important connection between gamblers and investors (and no, I am not talking about YOLOing your life’s savings on one bet). It’s imperative for gamblers to not lose their capital so that they can keep playing. In fact, it’s common sense to conserve your money and keep playing - because if you have an edge, the probability of winning over the long term is kept alive.1

The two key similarities between gambling and the stock market are:

Returns are reinvested

You have the choice to rebalance after every “round”

Let’s see how this affects long-term returns.

A simple experiment

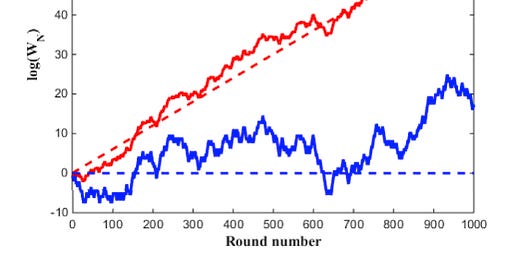

Consider an experiment where you toss a coin and there’s a 55% chance of it coming up heads. If you win, the amount you bet is doubled. In this situation, you have an edge. But that doesn’t mean you can bet everything on the first toss! There’s still a 45% chance of a tail and you could lose it all.

Let’s say you start with $100. How do you manage your capital?

There are many ways to adjust your bets.

For example, there’s Martingale where you keep doubling the wager after every loss hoping that a win will make up for your losses (e.g You lose $1, you bet $2. You lose $2, you bet $4, and so on). This works - until it ruins you completely.

Another strategy is to bet a small, fixed wager - of say $5 - every time. This helps you avoid ruin. On the other hand, the aversion to risk means passing up the opportunity for making money even when the odds are in your favor!

What if there was a way for you to bet more when conditions were favorable and bet less when it was risky? The blue line in the strategy does exactly that - That’s the best strategy for exponential gains!

Enter the Kelly criterion

John Kelly published the original paper on the Kelly criterion in 1956. Though the paper had a scientific-sounding name, it caused some controversy for its unconventional subject - How to place optimal bets in horse races. The premise was simple but powerful - While most gamblers/investors focused on their average winnings, Kelly sought to maximize the logarithm of expected winnings.2

In simple terms, past returns affected future returns, and because the same amount was being reinvested, the logarithm was the right measure to use because it measured how returns multiplied over time. Kelly did not make use of his own formula, but another mathematician, Edward Thorp, later used the Kelly criterion to beat the game of Blackjack.3 Ed Thorp went on to start the fund Princeton Newport Partners that gave 19-20% return net of fees for around 30 years without a single down year!

How did he do it?

Ed Thorp attributed much of his success to the Kelly Criterion. In its simplest form, the Kelly system increased investment in proportion to expected returns and decreased investment in proportion to risk. The system would work only when you had an edge in the market over others. It could not tell you what the edge was, but it did have a say in how to invest when you DO have an edge.

In practice, this amounts to rebalancing your portfolio according to the Kelly system.

How to invest with the Kelly system?

In practice, a simplified way to invest with the Kelly system is to invest more when the market is undervalued and invest less when the market is overvalued. In this study by Victor Haghani and James White of Elm Wealth in 2018, the Shiller PE ratio (CAPE) was used as a measure of whether the market was undervalued or overvalued.4

When the PE ratio is low, a larger fraction was invested in stocks and a lesser fraction was invested in T-bills, and vice-versa. As you can see in the graph below, the proportion invested dropped drastically just before the Dot-Com crash of 2000 and began to rise again after that. There was a huge increase in the invested amount after the crash of 2008. The fraction invested was capped at 100% (basically, no leverage).

The benchmark was a portfolio where 65% was invested in stocks and 35% was invested in T-bills throughout. The results were as follows (measured as of 2018):

In both the cases of investment starting in 1900 and 1950, the real returns using the proposed strategy are higher than a constant proportion portfolio of 65% - But more importantly, the risk-adjusted return is higher in all three cases!5 An investor using the Kelly system could have handled the turbulence in the markets in 2000 and 2008, while the volatility might have caused a fixed ratio investor to panic.

While a 3.67% return doesn’t seem much compared to 3.48%, compared over a period of 68 years, that translates to a gain of 1159% compared to 1023% - A difference of 136%!

Limitations

The Kelly criterion is arguably the best principle to rebalance your portfolio over the long term - But it doesn’t come without its fair share of criticism.

The Kelly Amount is technically the “correct” fraction to invest over the long term. But in the short term, this can lead to huge volatility and drawdowns in the portfolio value (as shown in the coin toss experiment graph above). That’s unnerving for any investor to watch!

Moreover, in real scenarios, it’s difficult to estimate the values required for the Kelly formula accurately, and investing more can lead to greater risk.

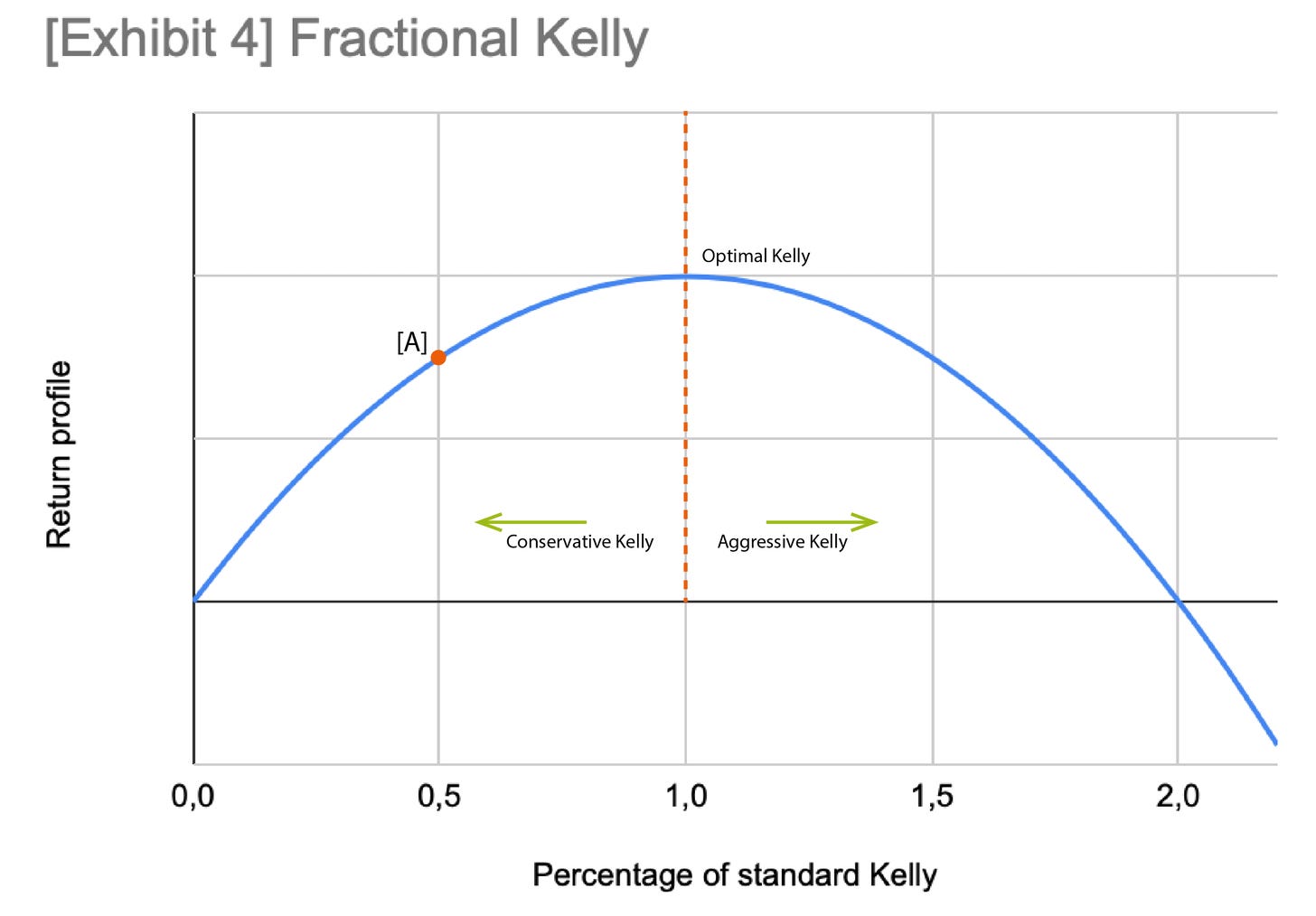

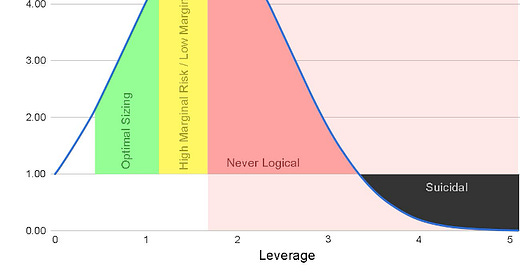

The graph below shows returns relative to risk with increasing asset allocation to equity. Notice that as the investing proportion crosses 1, the risk profile increases while the possible returns drop! Be very careful with leverage.

The sensible thing to do is to probably invest “fractional Kelly”, i.e adjust proportions according to the Kelly system but invest only half or a fraction suggested by the formula. As shown above, this cuts your risk by more than half while producing as much as 75% of the returns!6

Ed Thorp was the one who used Kelly to the greatest effect. Other noteworthy investors who used the Kelly criterion in one form or another include Jim Simons of the Medallion fund, Bill Gross, and even Charlie Munger and Warren Buffett!

Conclusion

This article is just the tip of the iceberg. But its intention is to show you that there are certain universal principles that underlie all investing approaches - Like volatility, compound interest, etc.

Asset allocation and rebalancing is one such fundamental principle that will make a huge difference to your portfolio if you understand it well. Now is also the right time to look into the impact of rebalancing because low trading commissions and low-cost ETFs make it an attractive time to use the advantages of rebalancing (but tax implications should be considered).

Do your research though! The Kelly system is simple in principle but not very straightforward to implement, so it’s another aspect to keep in mind when you have your next discussion with your financial advisor or look to learn more.

Until next week…

Join us on Twitter

Disclaimer: I am not a financial advisor. Do not consider this as financial advice. Fixed proportion investing works great for the majority of investors, but by learning to allocate wisely, you could enhance the performance further!

More interesting reads

Breaking the Market: This is one of my favorite blogs, written by Matt Hollerbach. Matt dives deep into the topics of Geometric Rebalancing and portfolio allocation. For those interested in the more technical aspects of this article in a simple and fun style, Breaking the Market is the place to go. Matt also manages a portfolio and open-sources his portfolio performance. It’s a great learning resource!

Fortune’s Formula by William Poundstone: The book that inspired this piece - a really fun read! Fortune’s Formula is a deep-dive into how the Kelly criterion was developed, but it reads like a heist adventure, with Thorp’s attempts to break the casino at Vegas, the US government’s fight against illicit trading, and a dramatic feud between investing geniuses and economists. If you read one book this year, this should be it.

If you enjoyed this piece, please do us the HUGE favor of simply liking it and sharing it with one other person who you think would enjoy this article! Thank you.

Morgan Housel says here that investing in Index Funds and investing in Venture Capital follow similar probability distributions, with the majority of returns attributed to a few winning picks - The only difference is the compression of the time frame. One could argue that gambling is a much larger compression, except that there’s no value creation here.

In Kelly’s words: “The gambler introduced here follows an essentially different criterion from the classical gambler. At every bet, he maximizes the expected value of the logarithm of his capital.”

In fact, he wrote a paper on it, and later a book (Beat the Dealer). He was so successful that casinos banned him from playing after a point!

The actual formula is more complicated and depends on Merton’s rule that takes into consideration μ the expected excess return, r the risk-free return, σ the risk expressed as standard deviation, and γ a measure of risk aversion.

Another method of investing in the spirit of the Kelly Criterion is to use geometric balancing. In real scenarios, while dividing capital among multiple assets, geometric balancing is a more reliable way to construct your portfolio.

While the Kelly system optimizes reinvestment of returns, you can still improve your average returns by diversifying across multiple investments over time.

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

Brilliant research, thanks!