Discover more from Market Sentiment

Welcome to the 250+ investing enthusiasts who have joined us since last Sunday. Join 25,850 smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

“In the short run, the market is a voting machine but in the long run it is a weighing machine.” - Ben Graham

The year was 1942 and World War 2 was at its peak. Researchers at the Center for Naval Analysis were faced with a challenging problem. Bombers were routinely getting shot down during their runs over Germany and the ones that came back were riddled with bullet holes. The researchers were tasked with improving the odds of a plane surviving a bombing run.

The simplest solution would be to add more armor to the plane. But armor would make the planes heavier and less maneuverable making them even more vulnerable. Using too much or too little would both be an issue. Since it’s an optimization problem, they turned to data and analyzed the bullet holes and damage that the bombers suffered after each run and a clear picture started to emerge.

Now the solution was simple - Add armor to the areas that had the maximum chance of getting hit so that you minimize damage to the aircraft. Can you see the flaw in the plan?

Before the modifications were made, famous statistician Abraham Wald reviewed the data and found a critical flaw in the analysis - They were only looking at planes that came back. The areas with the minimum bullet holes were actually the most important since any hit there downed the plane. Wald’s recommendation was quickly put into effect and was so successful that it’s still being used today.

Focusing too much on the wrong thing can guide us to the wrong solution even though it might look intuitive. That brings us to

Our Obsession with Stock Price

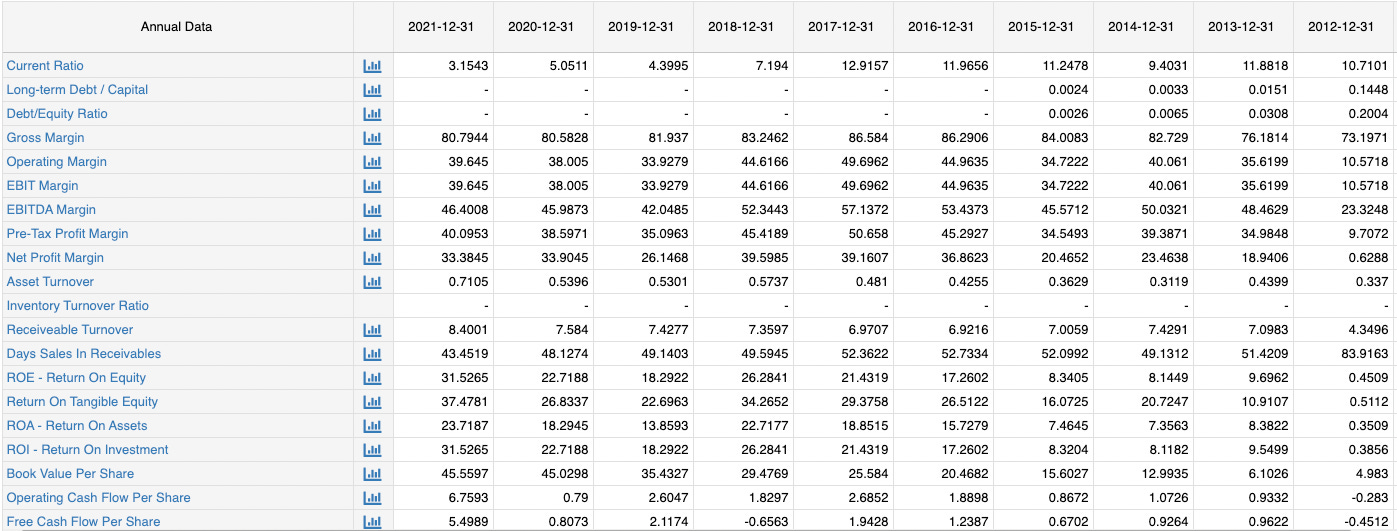

Let’s do a thought experiment1 - In this, you have ownership in a company, and the following are some of the key metrics of the company over the past 10 years.

Personally, I wouldn’t. It definitely looks like a healthy business. The company has consistently increased its revenue and more importantly its Return on Equity (ROE). The margin is stable and the EPS has also gone through a 3x rise in the past decade.

Now let’s look at the same company via the stock price lens. Every year the stock price fluctuated somewhere between -5% and -36% (Even if you remove the Covid crash, it’s still had an average max drawdown of -13%).

This is incredible - Even though the business had solid fundamentals and great growth, the market conditions and sentiment caused the stock to fluctuate. Imagine holding the business when it’s down 20% but the market is up 10%. You will start to question your investment decision and make all kinds of rationalizations to get out of the stock.

Finally, the company in our thought experiment was UnitedHealth Group. It would have generated over 1,000% return for you over the past decade if you had just held on to the stock disregarding the yearly fluctuations and quarterly reports. The problem is that the current format of reporting heavily focuses on stock prices. You will never see in the news a snapshot of key business metrics - It’s always alarmist-sounding narratives that the stock is down 15% from its ATH or that the company missed some arbitrary earnings estimate.

Pessimists sound smart, optimists make money

It’s easy to take the historical data of companies and then state that you should have held on to it. This article by Jason Crawford captures perfectly why it’s hard to be an optimist.

I’ve realized a new reason why pessimism sounds smart: optimism often requires believing in unknown, unspecified future breakthroughs—which seems fanciful and naive. If you very soberly, wisely, prudently stick to the known and the proven, you will necessarily be pessimistic.

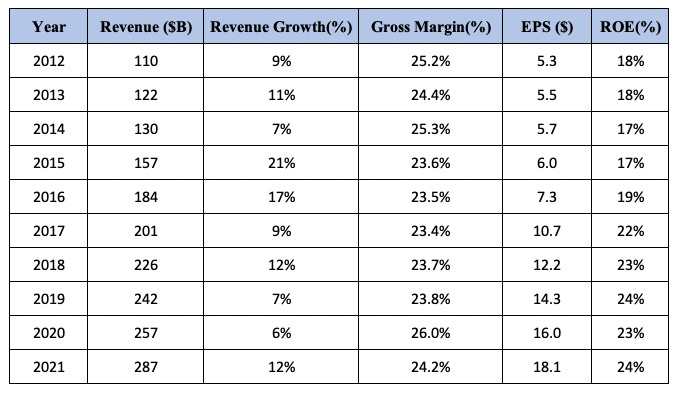

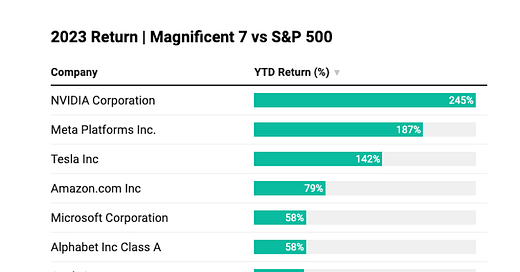

It’s hard to be positive about a company when there is article after article predicting the demise of the company based on one quarterly report. Case in point - Meta Platforms (Earlier Facebook) - No matter how you look at the company, the financial metrics are incredible. 80% gross margin and 30% ROE with growing revenue. But the stock is down 55% in the last 1 year.

I am not pitching it as a great business. They certainly have some incredible challenges ahead of them in terms of privacy and attracting a young user base. No one knows directly the solutions for their hardest problems—that’s why they’re the hardest ones. But writing off a company based on two bad quarterly reports is just too short-sighted.

Enduring Business Sucess

One of the biggest advantages that individual investors have is their ability to maintain a long-term time horizon. Professional investors, on the other hand, have to make it look like they are “working for their fees” and end up buying or selling stocks unnecessarily. We should be leveraging this by finding high-quality businesses and then holding them for a long time.

Nick Sleep, who ran a very successful investment fund had written on how to find exceptional companies. Instead of attempting to find how the stock will perform this quarter or what the analysts are predicting about the company, he wanted to focus on finding factors that will lead the company to success during both good and bad times2.

Sleep’s classic example was Walmart’s cost advantage. They offer the lowest prices on everyday merchandise and reinvest the profits back to gain even more scale advantage. Walmart, Costco, and Amazon all exhibit this business model and have achieved great success. Investors definitely understand this model but when the times are tough, they tend to undervalue these companies.

Investors sold Amazon after its Q2 earnings report because the next few quarters would face tough comps from the gangbuster 2020; but Amazon’s value in 2032 has little to do with the comps it faces in 2022. It has a lot to do with the durability of its network, the economies of scale, the distribution advantages, and the culture of operational excellence; none of that will likely drive the stock this quarter, but it’s what matters most to the stock over the next decade. - John Huber

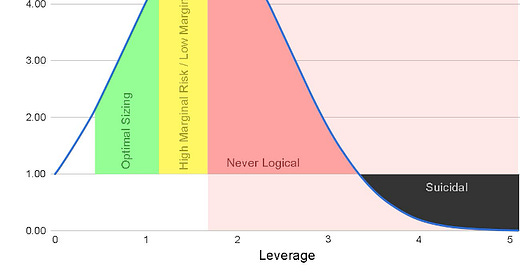

To be clear, I am not asking you to completely ignore the stock price. While making an investment, if you buy into an overvalued company, you will not make a profit no matter how long you hold it3. But once you make an investment, always think like the owner of the business instead of being a trader.

Amazon’s Founder Jeff Bezos puts it best

I never spend any time thinking about the daily stock price. At almost every all-hands meeting I say: ‘Look, when the stock is up 30 percent in a month, don’t feel 30 percent smarter. Because when the stock is down 30 percent in a month, it’s not going to feel so good to feel 30 percent dumber.

A lot of research went into this article and if you enjoyed it, please do me the huge favor of simply liking and then sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

Footnotes

This thought experiment is right out of 100 to 1 in the Stock Market by Thomas Phelps

Sources of Enduring Business Success - this is a must-read if you pick individual stocks and are a long-term investor.

Case in point - Cisco Systems still hasn’t surpassed its dot-com bubble stock price.

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

Thank you very very Much! Greetings From Argentina. We are always in a turbulent market, with a little portion of the society becoming rich, while the most becames poorer and poorer. This makes me think about how to win in this markets, and after some months reading you, Im doing it quite well here! Thanks again!

Well done...thank you for your work.