Discover more from Market Sentiment

Should you follow insider transactions?

I analyzed 4000+ insider trades made over the last 4 years and benchmarked the performance against S&P 500. Here are the results!

Hello folks 👋,

First of all, I would like to welcome the 172 new members to our little family 👨🏽🍼 since last week. We now have 6,300+ members in our community. Thank you for all the support :)

There is an old saying on Wall Street.

There are many possible reasons to sell a stock, but only one reason to buy.

If you think about it, you can sell stocks for any number of reasons - down payment for a house, a medical emergency, or just plain profit booking. But when you are using your hard-earned money to purchase a stock, there is only one reason. You expect the stock price to go up!

It’s not a hard stretch to imagine that company insiders who are in high-ranking positions (CXO’s, VP’s, Presidents, etc.) would have a better understanding of the company and its expected future performance than any financial analysts out there who are working just with publicly available data. So if these well-informed insiders are making significant stock purchases, does that mean they expect the stock price to shoot up soon?

In this week’s analysis, let’s put this theory to the test. Can you beat the market if you follow the stock purchases made by company insiders?

Data

The data for this analysis was taken from openinsider.com

it’s a free-to-use website that tracks all the trades reported on SEC Form 4 [1]. While there are a lot of transactions that are reported daily to the SEC, I applied the following constraints to reduce noise in the data.

Only transactions done by CXOs, VPs and Presidents (people who have a significant view of the company strategy and operations) are considered.

A minimum transaction value of 100K

The transaction should be a purchase (Not a grant, gift, or purchase due to options expiration)

The financial data used in the analysis is obtained from Yahoo Finance.

Analysis

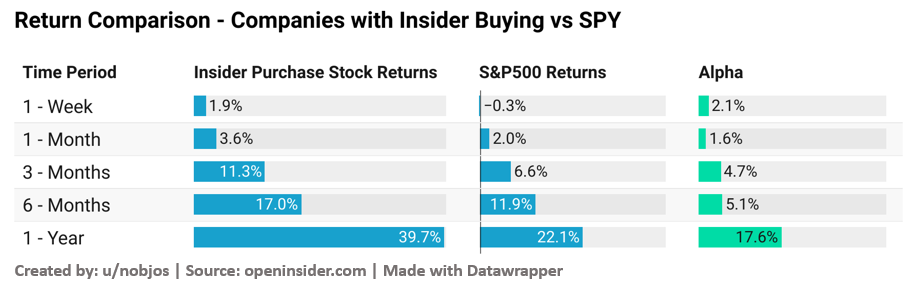

For all the transactions, I calculated the stock price change across different time periods (1 Week, 1 Month, 3 Months, 6 Months & 1 Year) and then benchmarked the returns against the S&P500 over the same time period.

My hypothesis for choosing different time periods was to understand at what point we would generate the maximum alpha (if we realize any) over the benchmark. All the results are checked for outliers so that one or two stocks are not biasing the whole result.

Results

Surprisingly, if you had followed the insider purchases, you would have beaten SPY across all 5 different timeframes. The alpha generated would also have increased with increasing timeframe with the insider purchase trades beating the S&P500 by a whopping 17.6% over the period of one year.

I have kept the 1 Year timeframe as my limit mainly due to two reasons. First, I started the analysis for identifying short-term plays, and secondly, given our entire dataset is over the last 4 years, any period of more than 1 year would not have data for a significant chunk of our sample set which can affect the analysis.

But the number of trades that made positive returns shows a different story. When compared to trading SPY, a lesser number of trades would have generated profits in the case of following insider purchases.

The key insight here is that while the chances of your trading making a profit are lower, if you do end up making a profit, you would generally have had a better return than the market.

Limitations to the Analysis

There are some limitations to the above analysis that you should be aware of before trying to replicate the trades.

The data I collected has a lot of small-cap companies which are inherently more risky than a large-cap index like S&P500. Given that our returns are not risk-adjusted, the alpha we are seeing here might just be due to the higher risk you are taking on the trades. [2]

The analysis is limited to the last 4 years of data during which the markets were predominantly in a bull run (except during the Covid-19 crash).

Finally, this assumes that you will buy an equal amount of stock in all the trades whenever a company insider does a trade, which might not be practical given our inherent biases and apprehensions.[3]

Conclusion

Usually, insider purchases are used to gauge the overall market sentiment. A very high proportion of sells over buys signifies that insiders are losing confidence in the stock/industry and it’s time to get out of that market.

This analysis shows that the individual trades can be used for identifying stocks that are worth buying by analyzing the insider purchase patterns. This should be just considered as a primer on the topic as the SEC Form 4 has a treasure trove of information [4].

You may or may not implement this strategy based on your investment style. But at the very least, you should check for the insider transaction pattern before investing in a particular security!

Google Sheet containing all the data used for analysis: Here

Until next week…

Footnotes and Existing Research

[1] SEC Form 4 is what an insider files when he/she makes a transaction. It’s expected to be filed within 2 days, but I observed more delay than that in many cases. For the purpose of this analysis, I have considered transactions that were reported no later than 10 days.

[2] Estimating the Returns to Insider Trading: A Performance-Evaluation Perspective : This study published by Leslie A. Jeng and Richard Zeckhauser of Harvard found that insider purchases beat the market by 11.2% per year. Even after adjusting for the risk using the CAPM model, the returns beat the market by 8.5%

[3] Very few people have the ability to keep their emotions away from the trades when a significant chunk of their money is at stake.

[4] You can filter for the role of the insider (for eg, if you want to track only the CEO purchase/sales), industry, percentage ownership change, the current value of stock owned, etc. There are thousands of permutations in which you can do this analysis to find some alpha.

[5] Multiple research papers over the last 3-4 decades [eg.1, eg.2] have shown that insider purchases significantly outperformed the market

If you found this insightful, please share it with your friends :)

WhatsApp | Facebook | Twitter | Reddit

How would you rate this week’s newsletter?

PS: Some of you have reached out to me stating that this newsletter is going to the promotions tab instead of the primary inbox in Gmail after I have shifted to Substack. This is mainly due to the usage of $ symbols for Stock tickers and using the terms Buy and Sell for analyst recommendations. Google AI mainly classifies emails containing these words as promotional e-mails.

It would be awesome if you could mark this e-mail as important or move it to primary or add Market Sentiment to your contacts or just reply to this email with a “hi” or any questions you have so that it always comes to your primary inbox and you won’t miss out on the weekly posts. Thank you :)

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

How did you factor in multiple trades in the same company, such as the same person buying stock on different days, or multiple insiders buying stock in the same company? Do you count each of those as a new transaction?