Discover more from Market Sentiment

Welcome to the 390 investing enthusiasts who have joined us since last Sunday. Join 27,000+ smart investors and traders by subscribing here. It’s totally free :)

Check out our - Best Articles | Twitter | Reddit | Discord

Show me the incentive and I will show you the outcome.

- Charlie Munger

It’s fascinating how a number going up by 0.75 in the United States can play havoc with the finances of people across the globe.

Pensioners in the UK faced the unimaginable on Thursday. They saw their life savings nearly disappear when the bond market went into pandemonium, after an eccentric and sudden policy change by the government. 90% of UK pension funds would have been wiped out.1 How did the UK witness what some have called a “Lehman moment” - with one of the safest investments you can think of?

While “The Big Short” was heavily dramatized, it got one thing right: Catastrophes aren’t caused by malice or one greedy move. They are caused by a long chain of incentives. In this case, pressure to show better returns on the balance sheets drove UK pension fund managers to take on leverage by investing in Liability-Driven Investments (LDIs). These are derivative instruments that use the assets they own as collateral. As gilt prices dropped, pension funds started to get margin-called, and the situation would have spiraled out of control quickly if the Bank of England had not intervened.2

But that’s across the Atlantic Ocean, you say. If the US Dollar is growing stronger, won’t investors flock to the safe alternative making the US stock market perform better in the long run? It isn’t as simple as that. Currencies around the world are being decimated by the dollar - And it might come full circle to bite the US stock market. First, what does a strong currency actually mean?

Strong money, weak investment

Before we jump in,

You know that I’m a big proponent of diversification - Never put all your eggs in one basket. The markets are unpredictable and you're probably exploring how to diversify your money. Commercial real estate can be your answer.

That’s why I’m excited about LEX. Truth is, the best deals in real estate are hard to find, unless you’re accredited and have access. Even then, you’ve got scarce deals, crowdfunding, or REITs to choose from. Until LEX.

LEX IPOs buildings so you can get in the game. By taking buildings public, LEX has created a way for you to invest in marquee commercial real estate. Build a portfolio by picking the buildings you want to invest in. Each building gets a ticker and can trade like your other stocks.

As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax-advantaged passive income and trade without lockups. Get started today and explore LEX’s live assets in New York City and upcoming IPO in Nashua, NH.

Sign up for free here and get a $50 bonus when you deposit at least $500.

*This is sponsored content.

Alright, now back to it. Money has two uses: It can be spent or it can be stored. When money is weak, its value decays over time. This incentivizes people to spend and invest their money because inflation would eat up their returns. It’s also a way to promote economic growth - if your money can’t store value, you’ll try to transfer it elsewhere. When money is strong, on the other hand, you tend to save it. Money becomes more valuable compared to the investments out there, and commodity prices drop.

There are arguments both for weak money (fiat monetary policy) and strong money (Bitcoin, Gold standard) but governments regulate the strength of the currency relative to the dollar based on their priorities. This in turn affects different aspects of the economy. Some factors to consider are:

Growth vs Stability: Weak money encourages new businesses and foreign investors to take risks. Strong money pushes people to safer alternatives.

Dependencies: If fuel or other basic commodities are major imports, weak currency is damaging because fuel prices are denominated in dollars.

Export vs Import economy: An export economy benefits from a weaker currency as they get paid in a stronger currency. An import economy benefits from a stronger currency as their money goes a long way. Most countries have a mix of the two, but fuel is a major import in many countries other than the US.

Globalization: This is the kicker. A stronger currency will make company profits from across the world less valuable in the home country. We’ll return to this.

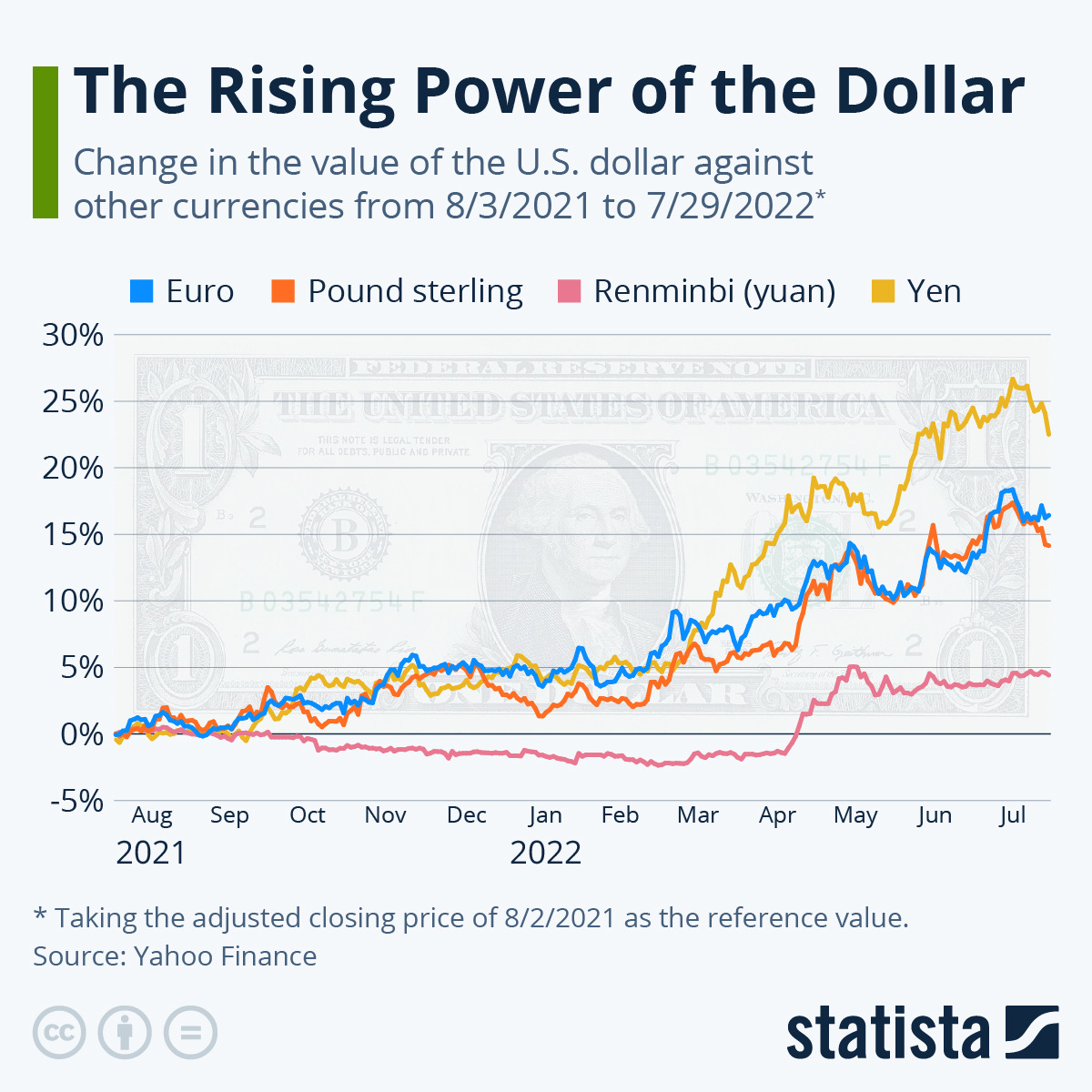

These factors can change with time, and countries will react according to how the other players on the chessboard move.3 The US is the driving force in the markets right now: When it prints money, markets are euphoric, and when it raises rates, the world recoils. Here’s how the currencies of the world are faring against the dollar.

A one-sided currency war?

The era of free money in America is coming to an end - Growth was the only mandate in a decade where interest rates were suppressed to record lows. Now, Jerome Powell faces the Kobayashi Maru of fighting both inflation and recession at the same time. Since the labor market is strong and the cost-of-living crisis seems like the more urgent one, investors in the stock and housing market are watching with no recourse as rate hikes are rolling out, 75 basis points at a time.

But the turmoil in other countries is far worse. The Japanese Yen fell victim to speculation after the latest rate hike as the dollar rose to 146 Yen - more than 25% since the beginning of the year. The Bank of Japan had to step in and buy Japanese Yen on the international market for the first time in 24 years, before it stabilized.

The Pound Sterling in UK collapsed to a multi-decade low for a different reason. The new government chose to implement aggressive tax cuts that spooked the bond markets and set the pension fund crisis rolling. While the government hopes to curb inflation and encourage foreign investment, experts are afraid that a weaker pound will result in higher inflation in the long run.

The Chinese Renminbi Yuan has also fallen to a record low against the dollar.

The largest impact is on the European members of the G7, as they struggle not only against the dollar but also with military conflict next door. The Ukraine-Russia war which started in February shows no signs of ending. Germany, France, and other countries are dependent on Russia for fuel, and the rate hikes couldn’t have come at a worse time. With the Nord pipeline from Russia sabotaged, European countries will have to turn to expensive fuel imports purchased with weakening currencies as winter turns around the corner.

But these are just the short-term effects. In the long term, the worst affected country could be America itself.

The problem with globalization

In the late 1970s, the dollar was strong as it is now, and it began to hurt other countries - as well as the US. In 1985, America, Japan, and a handful of European countries came together in the Plaza Accord to intervene in the currency markets. The intervention worked a bit too well, and the dollar fell by more than 40% before the accord was reversed. There are two problems with the current situation:

China and Russia are major players in the world economy. China is a manufacturing giant, and Russia moves fuel markets. An accord with either is not as easy, even without the geopolitical tension in the air.

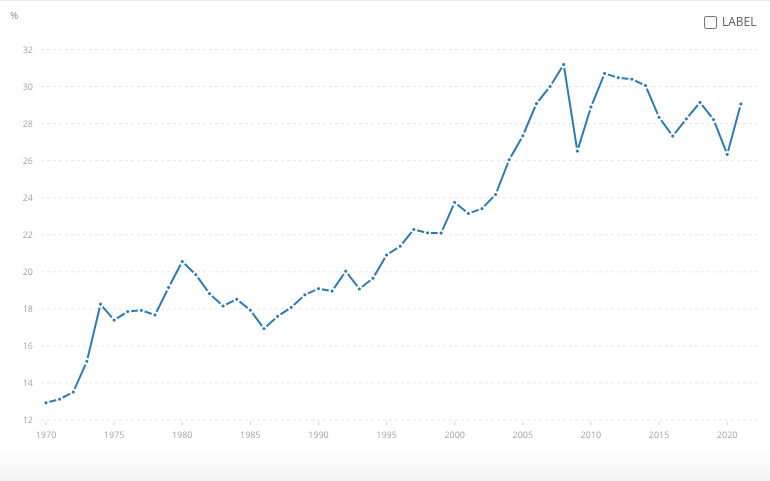

Trade is much more globalized now. In fact, the export of goods and services as a percentage of GDP is about 30% now, compared to 13% in 1970!

In 2019, foreign sales accounted for 29% of the revenue of S&P500 companies - If the currencies in other countries become weaker, the earnings in those places reported in dollars would be much lower and it might affect the stock price of companies in the US. In fact, American companies with high domestic sales have outperformed companies with international sales by 9% this year - and as global currencies grow weaker, this rift will widen.

So where does that leave us? The trends show that investors in Europe are exiting equity markets at a speed not seen since the Eurozone Crisis of 2009. US investors are doing the same, as they fear that the real cost of equity is now much higher and bonds promise a guaranteed return for much lesser risk.

If you have a shorter time horizon, with retirement coming up or a big expense planned soon, it might be a good idea to shift some portion of your investment to short term 2-3 year treasury bills as it limits the downside. Even a small cash reserve isn’t a bad idea. For investors with a longer horizon, this could be a buying opportunity for equities (though companies with high international revenue might suffer in the short term). Staying your course would pay off in the long run.

That’s it for this week’s deep dive. Let me know in the comments what your strategy for the upcoming months is:

If you enjoyed this piece, please do me the huge favor of simply liking and sharing it with one other person who you think would enjoy this article! Thank you.

Disclaimer: I am not a financial advisor. Please do your own research before investing.

According to Kerrin Rosenberg of Cardano Investment, who manage more than £50 Billion in 30 pension funds.

Like Matt Levine says: “If you have a pot of money that is immune to bank runs, over time, modern finance will find a way to make it vulnerable to bank runs.” I call it Levine’s Law. Matt’s explanation of the UK pension fund crisis is an excellent read.

That’s a big simplification. The reality is more like this complex web sketched out by Rohit Krishnan. But we can work with the major factors for now.

Subscribe to Market Sentiment

Actionable, data-backed investment insights for long-term investors, financial advisors, and analysts.

Our whole lives are controlled.